Ever booked a dream vacation, picturing yourself sipping cocktails on a pristine beach in Bali, only to be jolted back to reality by the cost of travel insurance? You might wonder, “Why Is Travelers Insurance So Cheap compared to the potential costs it covers?” Well, buckle up, wanderlust friends! We’re about to demystify the world of travel insurance and explain why those seemingly low premiums pack a punch of protection.

The Economics of Travel Insurance: It’s All About the Odds

You see, insurance companies are like seasoned travelers themselves; they understand risk. They crunch numbers, analyze data, and use those insights to determine the likelihood of you, the traveler, actually needing to use your insurance.

Think of it like this: hundreds of people might board a plane, but only a tiny fraction might experience a lost bag or a flight delay. This principle of shared risk allows insurance providers to offer affordable coverage because they’re spreading the cost across a large pool of travelers.

Factors that Influence Travel Insurance Costs

Several key factors play into how your travel insurance premium is calculated. Here’s a peek behind the curtain:

- Your Age and Health: Generally, younger and healthier travelers represent a lower risk and may enjoy lower premiums.

- Destination and Trip Length: Heading off the beaten path to a more remote corner of the world? Longer trips and adventurous destinations can sometimes come with slightly higher premiums due to increased potential risks.

- Coverage Options: Basic plans covering lost luggage or trip cancellations usually cost less than comprehensive packages that include medical emergencies, adventure sports, or high-value belongings.

- Deductibles and Coverage Limits: Opting for a higher deductible (the amount you pay out of pocket before insurance kicks in) can often lower your premium. Similarly, choosing lower coverage limits can reduce the overall cost.

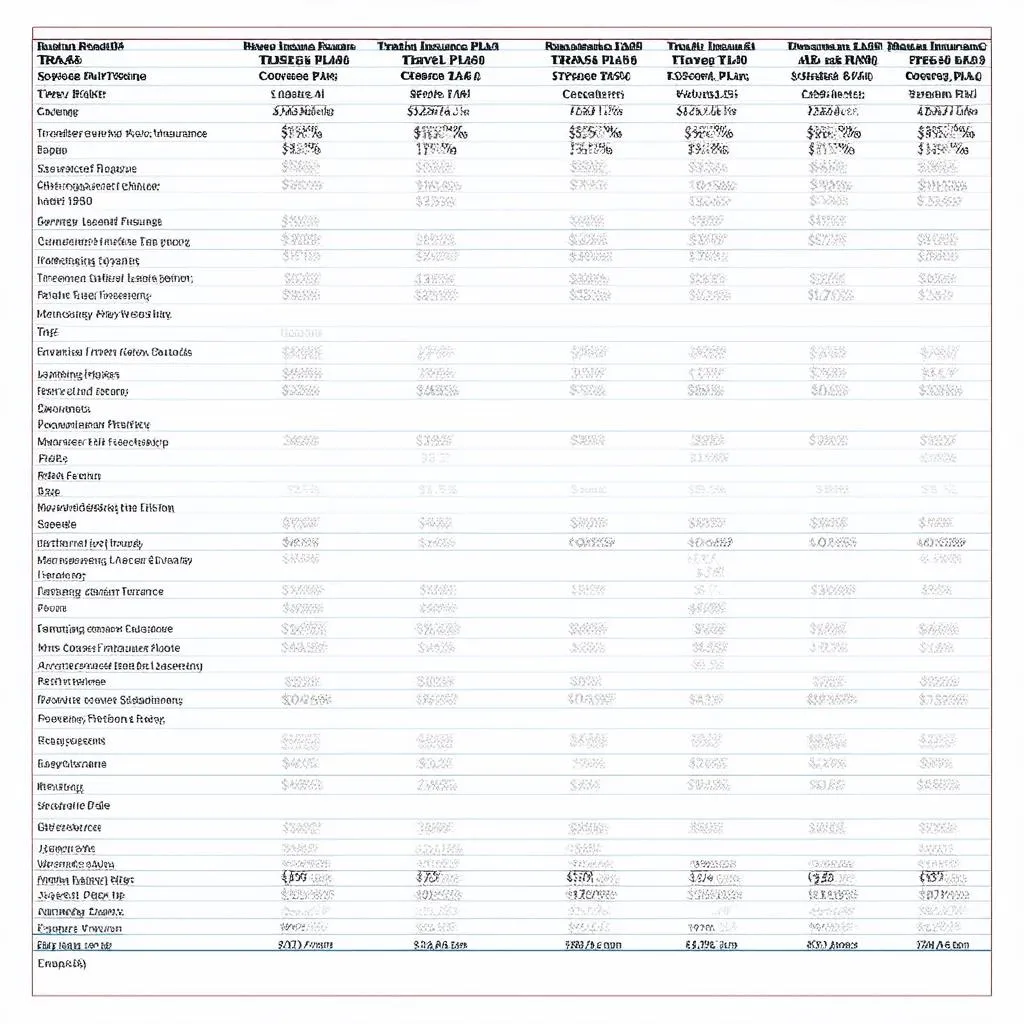

Travel Insurance Comparison Chart

Travel Insurance Comparison Chart

Don’t Be Fooled by “Cheap” – Look for Value

While affordability is appealing, remember that the cheapest option isn’t always the best fit. Just like choosing the right travel backpack, selecting travel insurance is about finding the right balance between cost and coverage for your specific needs.

- Read the Fine Print: Don’t skim over the details! Understand what’s covered, what’s excluded, and the claims process.

- Consider Your Itinerary: Planning to climb Mount Kilimanjaro or go scuba diving in the Great Barrier Reef? You’ll need adventure sports coverage. Tailor your policy to your activities.

- Check for Pre-existing Conditions: Some policies have limitations on pre-existing medical conditions, so it’s crucial to disclose your health history accurately.

- Look for Reputable Providers: Choose an established and well-regarded insurance company with a strong track record of customer service. Need a place to start? Our article on “A Quote for Travel Insurance” provides some helpful guidance.

Travel Insurance: Peace of Mind for Priceless Adventures

Ultimately, the beauty of travel insurance lies in its ability to provide peace of mind. It’s about knowing you have a safety net should the unexpected occur, allowing you to embrace those spontaneous detours and unexpected adventures that make travel so enriching.

A Traveler’s Tale from the Streets of Hanoi

Picture this: You’re lost in the labyrinthine alleys of Hanoi’s Old Quarter, captivated by the aroma of street food and the vibrant chaos. Suddenly, your wallet disappears, likely snatched by a nimble-fingered thief. Panic sets in. But wait! You remember your trusty travel insurance. Relief washes over you as you realize you can recover your stolen funds and replace essential documents.

This fictional scenario illustrates how even a small investment in travel insurance can prevent a minor mishap from derailing your entire trip.

Travelers Exploring Hanoi, Vietnam

Travelers Exploring Hanoi, Vietnam

FAQs About Travel Insurance Costs

Q: Does travel insurance cover pandemics?

A: Some policies offer coverage for pandemics, but it’s essential to check the specific terms and conditions.

Q: Can I buy travel insurance after I’ve booked my trip?

A: Yes, you can usually purchase travel insurance after booking your trip, but it’s generally best to do so as early as possible to maximize coverage options.

Q: What’s the difference between travel insurance and credit card travel insurance?

A: While some credit cards offer travel insurance as a perk, coverage can be limited. Standalone travel insurance often provides more comprehensive protection.

Travel with Confidence: Explore More with travelcar.edu.vn

Want to delve deeper into the world of travel insurance and discover even more tips for planning your perfect trip? Head over to travelcar.edu.vn for a wealth of resources and expert advice. From understanding the ins and outs of travel insurance to uncovering hidden gems in destinations worldwide, we’ve got you covered!