Picture this: you’re strolling down the Champs-Élysées, baguette in hand, living your best Parisian life. Suddenly, disaster strikes! You trip, twist your ankle, and need medical attention. This dream vacation could turn into a financial nightmare without the right travel insurance.

But with so many options out there, finding the best international travel insurance can feel like navigating the backstreets of Marrakech. Don’t worry, we’re here to guide you!

Understanding Your International Travel Insurance Needs

Before diving into specific plans, let’s define your travel “personality.” Are you a fearless backpacker conquering the Inca Trail or a luxury traveler indulging in a Balinese spa retreat? Your travel style, destination, and activities heavily influence the type of coverage you need.

Ask yourself:

- Where are you going? Some countries, like those in the Schengen Area, require travel insurance for visa applications.

- How long are you traveling? Short trips might require different coverage than extended backpacking adventures.

- What activities will you be doing? Bungee jumping in New Zealand? Scuba diving in the Great Barrier Reef? Adventure activities often require additional coverage.

Key Coverage Options for International Travel Insurance

No matter your travel style, every best international travel insurance plan should include these essential coverages:

1. Emergency Medical Expenses: This covers unexpected medical costs like hospital visits, surgery, or emergency medical evacuation. Imagine breaking your leg hiking the Himalayas; this coverage ensures you receive quality care and safe transport.

2. Trip Cancellation/Interruption: Life happens! This protects your investment if you need to cancel or cut your trip short due to unforeseen events like illness, natural disasters, or family emergencies. For instance, imagine a volcanic eruption disrupting your Iceland adventure; trip interruption coverage reimburses your non-refundable expenses.

3. Baggage and Personal Belongings Coverage: From lost luggage in the chaos of Heathrow Airport to stolen belongings in a crowded Barcelona market, this coverage offers financial protection for your valuables.

4. Travel Delay Coverage: Missed connecting flights or unexpected delays can throw a wrench in your travel plans. This coverage helps with expenses incurred due to delays, like meals and accommodations.

Finding the Best International Travel Insurance for You

1. Compare Quotes from Reputable Companies: Don’t settle for the first quote you see. Utilize online comparison websites and directly contact insurance providers to find the best value for your needs.

2. Read the Fine Print: Before committing, thoroughly understand the policy’s terms and conditions. Pay close attention to coverage limits, exclusions, and the claims process.

3. Consider Additional Coverage Options: Depending on your travel plans, consider these options:

- Adventure Sports Coverage: Essential for activities like skiing, scuba diving, or rock climbing.

- Pre-existing Medical Condition Coverage: If you have pre-existing conditions, seek policies that cover potential complications during your trip.

- Rental Car Insurance: Protect yourself against damages or theft when renting a car abroad.

“The biggest mistake travelers make is assuming their existing health insurance covers them internationally. Always invest in dedicated travel insurance for peace of mind,” advises Sarah Thompson, travel expert and author of “The Ultimate Travel Guide.”

Planning Your Trip? Don’t Forget These Travel Feng Shui Tips

Incorporating a touch of Feng Shui into your travel plans can attract positive energy and enhance your journey. Here are a few tips:

- Choose destinations aligned with your travel intentions. Seeking adventure? Head south for fiery energy. Craving relaxation? East-facing destinations offer tranquility.

- Pack with intention. Select colors and items that symbolize your travel aspirations.

- Maintain a clean and organized travel space. A clutter-free environment promotes positive energy flow.

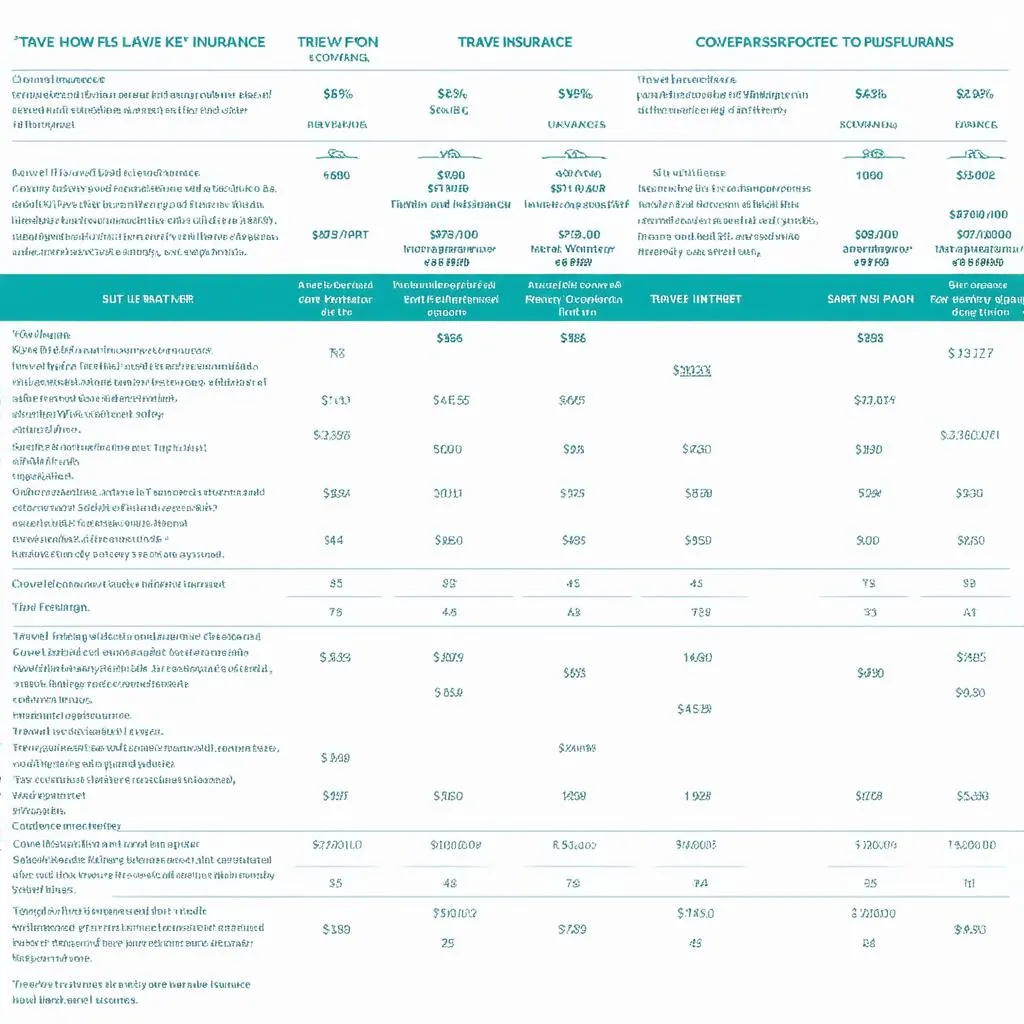

Travel Insurance Comparison

Travel Insurance Comparison

FAQs about International Travel Insurance

Q: Do I really need travel insurance if I’m only going on a short trip?

A: Absolutely! Even short trips come with unforeseen risks. A sudden illness or a missed flight can quickly derail your plans and lead to unexpected expenses.

Q: What if I need to cancel my trip due to a family emergency?

A: Travel insurance with trip cancellation coverage will reimburse your non-refundable expenses if you need to cancel your trip due to a covered reason, including family emergencies.

Q: Does travel insurance cover pre-existing medical conditions?

A: It depends on the policy. Some plans offer limited coverage for pre-existing conditions, while others require specific add-ons. Carefully review the policy details or consult with the insurance provider.

Packing for a Trip

Packing for a Trip

Travel with Confidence with the Right Insurance

Choosing the best international travel insurance involves careful consideration of your individual needs and travel style. By understanding the different coverage options and comparing policies, you can embark on your next adventure with peace of mind, knowing you’re protected against the unexpected.

For more travel tips and resources, visit travelcar.edu.vn. From understanding visa requirements for destinations like the majestic Taj Mahal in India to finding the best travel insurance for seniors, we’ve got you covered. Safe travels!