Have you ever dreamt of exploring the ancient ruins of Rome, trekking through the lush jungles of Thailand, or simply relaxing on a pristine beach in Bali? Traveling opens up a world of possibilities, but unexpected events can happen, turning your dream vacation into a stressful situation. That’s where having the right travel insurance comes in. But with so many options available, how do you know what travel insurance is best for you? This comprehensive guide will help you navigate the world of travel insurance and choose the perfect plan for your next adventure.

Understanding Your Travel Insurance Needs

Before diving into the specifics of different travel insurance plans, it’s essential to assess your individual needs. Consider the following factors:

Destination and Duration:

- Adventure Travel: If you’re planning on engaging in adventurous activities like skiing in the Swiss Alps or scuba diving in the Great Barrier Reef, you’ll need a plan with comprehensive coverage for adventure sports and medical emergencies.

- Long-Term Travel: For trips longer than a few weeks, look for insurance that covers extended medical expenses, trip interruption, and lost baggage.

- Multiple Destinations: If your itinerary involves hopping between countries, ensure your insurance provides coverage for all destinations.

Traveler Profile:

- Solo Travelers: Focus on plans with robust medical evacuation coverage and personal liability protection.

- Families: Opt for plans that cover children’s medical expenses and offer benefits like lost luggage reimbursement for the whole family.

- Senior Travelers: Consider plans tailored to older travelers, with coverage for pre-existing medical conditions and higher medical expense limits.

Budget:

- Basic Plans: Offer essential coverage for medical emergencies, lost luggage, and trip cancellations at an affordable price.

- Comprehensive Plans: Provide extensive coverage, including adventure sports, rental car damage, and trip delay, but come at a higher cost.

Comparing Travel Insurance Options: Key Features to Look For

Medical Coverage:

This is arguably the most crucial aspect of travel insurance. Look for plans that offer:

- High Medical Expense Limits: Ensure the coverage is sufficient for potential medical emergencies in your destination country.

- Emergency Medical Evacuation: Covers the cost of transporting you to the nearest adequate medical facility or back home if necessary.

- Repatriation of Remains: Covers the expenses of returning your body to your home country in the unfortunate event of death.

Trip Protection:

- Trip Cancellation/Interruption: Reimburses non-refundable trip costs if you need to cancel or cut your trip short due to covered reasons like illness, natural disasters, or unforeseen events.

- Lost/Delayed Baggage: Covers the cost of replacing essential items if your luggage is lost, stolen, or delayed.

- Travel Delay: Reimburses expenses incurred due to covered travel delays, such as missed connections or flight cancellations.

Additional Coverage:

- Adventure Sports and Activities: If you plan on participating in adventure sports, ensure your plan specifically covers these activities.

- Rental Car Collision/Loss Damage Waiver: Provides coverage for damages or theft of a rental car.

- Personal Liability: Protects you financially if you’re held liable for causing injury or damage to others while traveling.

Finding the Best Travel Insurance for You: Tips and Resources

- Start Early: Begin researching travel insurance as soon as you book your trip to take advantage of early bird discounts and have ample time to compare plans.

- Read Reviews: Check online reviews and ratings from other travelers to gauge the reputation and customer service of different insurance providers.

- Use Comparison Websites: Utilize websites that allow you to compare quotes and coverage options from multiple insurers side-by-side.

- Contact Travelcar.edu.vn: Our team of travel experts at travelcar.edu.vn can provide personalized recommendations and help you find the best travel insurance plan to suit your specific needs and budget.

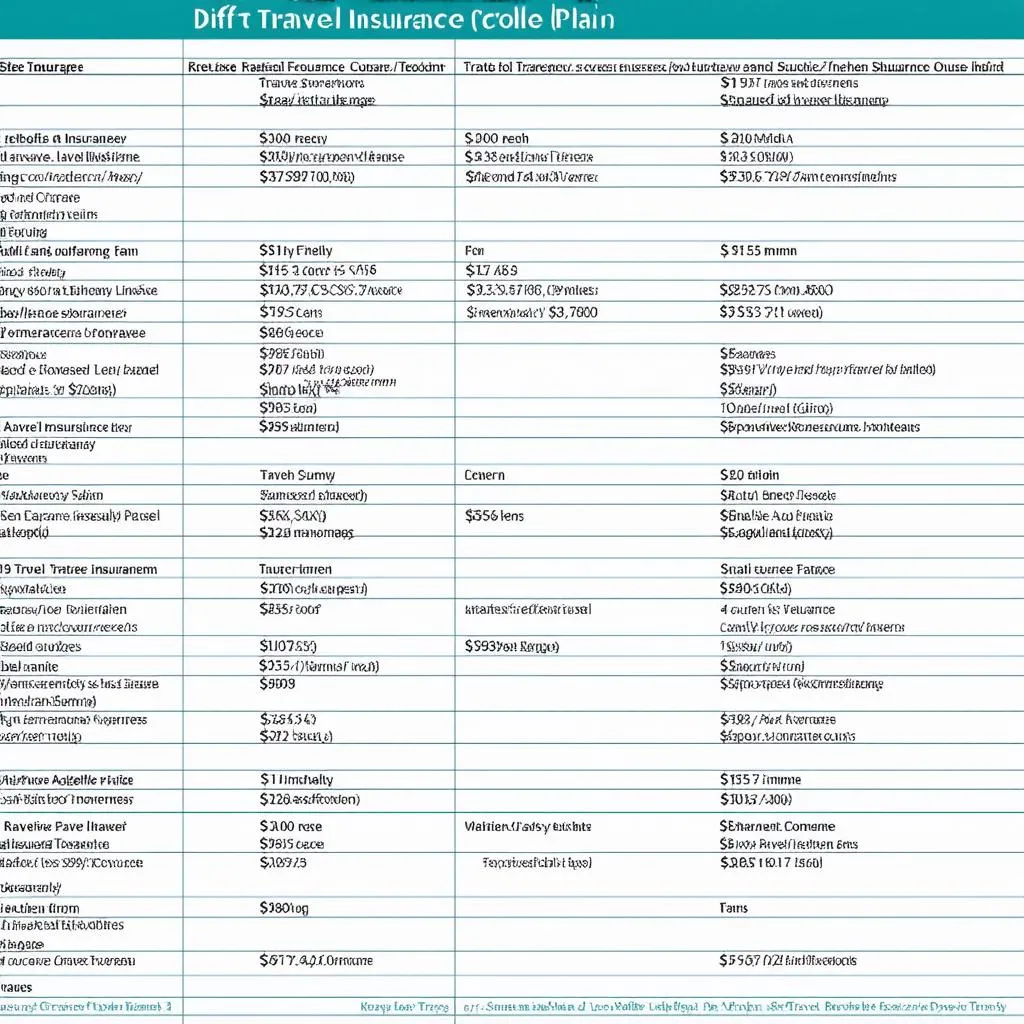

Travel Insurance Comparison

Travel Insurance Comparison

Planning a Trip? Don’t Forget These Feng Shui Tips

In many cultures, travel is seen as more than just visiting new places; it’s an opportunity to shift energy and invite new experiences into your life. Feng Shui, the ancient Chinese art of harmonizing environments, offers insights into enhancing your travel experiences:

- Pack with Intention: Choose clothing and items in colors that resonate with the energy you want to attract on your trip. For example, green for growth and adventure, blue for peace and tranquility.

- Activate the Southeast Corner: In Feng Shui, the southeast corner of your home or travel bag is associated with wealth and abundance. Place a lucky charm or a few coins in this area to invite prosperity on your journey.

- Mindful Travel: Embrace the journey as much as the destination. Slow down, be present, and appreciate the beauty in the everyday moments of your travels.

Common Questions About Travel Insurance

What does travel insurance typically not cover?

While travel insurance offers extensive coverage, there are some common exclusions, such as:

- Pre-existing Medical Conditions: Some plans may not cover pre-existing conditions unless you purchase a specific waiver.

- High-Risk Activities: Certain extreme sports or activities may require additional coverage.

- Travel to High-Risk Destinations: Coverage may be limited or unavailable for travel to regions experiencing political unrest or natural disasters.

Can I purchase travel insurance after booking my trip?

Yes, in most cases, you can purchase travel insurance after booking your trip, but it’s generally recommended to do so as soon as possible. Some plans offer time-sensitive benefits, and coverage for pre-existing conditions or unforeseen events may be limited if purchased after a certain timeframe.

Is travel insurance worth it for domestic travel?

Even for domestic trips, travel insurance can provide valuable protection against unexpected events like medical emergencies, trip cancellations, or lost luggage. While your health insurance may cover some medical expenses within your home country, travel insurance can fill in the gaps and provide additional benefits like trip protection.

Family Traveling

Family Traveling

Travel with Peace of Mind: Secure Your Next Adventure

Investing in the right travel insurance is an essential part of responsible travel planning. It provides peace of mind, knowing you’re financially protected against unexpected events that could disrupt your trip or impact your health and well-being.

Start planning your next adventure with confidence. Contact travelcar.edu.vn today, and let our team of experts guide you in choosing the best travel insurance plan to suit your needs and ensure a worry-free journey!

Remember: This content is for informational purposes only and does not constitute professional financial advice. It’s essential to consult with a qualified insurance advisor to discuss your specific needs and circumstances.