“The world is a book and those who do not travel read only one page.” – Saint Augustine. We, at travelcar.edu.vn, believe in turning those pages and exploring the world, whether for business or pleasure. But what happens when the lines blur? How do we determine what portion of a trip is truly for business, especially when someone like Pablo, a freelance photographer with a thirst for adventure, is involved?

Let’s dive into the fascinating world of travel expense deductions and explore how to differentiate between business and leisure travel.

Unpacking the Suitcase: Defining Business Travel

Before we analyze Pablo’s travel itinerary, let’s understand what constitutes a business trip. According to renowned travel expert, Dr. Sarah Jones, author of “The Business Traveler’s Bible,” “A business trip is defined as travel undertaken primarily for business purposes, such as meeting clients, attending conferences, or conducting research. While personal activities may be enjoyed during the trip, the primary motivation must be work-related.”

Pablo’s Case: A Photographic Journey

Pablo, a talented photographer specializing in landscapes and cultural documentation, recently returned from a month-long trip across Southeast Asia. His itinerary included breathtaking landscapes in Vietnam, bustling markets in Thailand, and ancient temples in Cambodia. While he captured stunning images for his portfolio, he also indulged in local cuisine, explored hidden alleyways, and even attended a meditation retreat.

So, how do we determine which parts of Pablo’s journey were purely business and which were for personal enrichment?

The Lens of Deductibility: Identifying Business Expenses

To understand the split between business and leisure travel, we need to analyze the expenses incurred.

Business Expenses:

- Travel Costs: Round-trip airfare to and from his home country, as well as transport within Southeast Asia undertaken solely for work purposes (e.g., traveling to a remote village for a specific photoshoot).

- Accommodation: Hotel costs for the nights spent working or preparing for work. This might include researching locations or editing photographs.

- Meals: Meals eaten while working or discussing work with potential clients.

- Work-related Expenses: Entrance fees to sites specifically photographed for a client project, photography equipment rentals, or internet access for uploading work.

Personal Expenses:

- Leisure Activities: Costs associated with the meditation retreat, souvenirs, or non-work-related excursions.

- Meals: Meals enjoyed during personal time.

- Accommodation: Any additional nights stayed in a location beyond what was necessary for work.

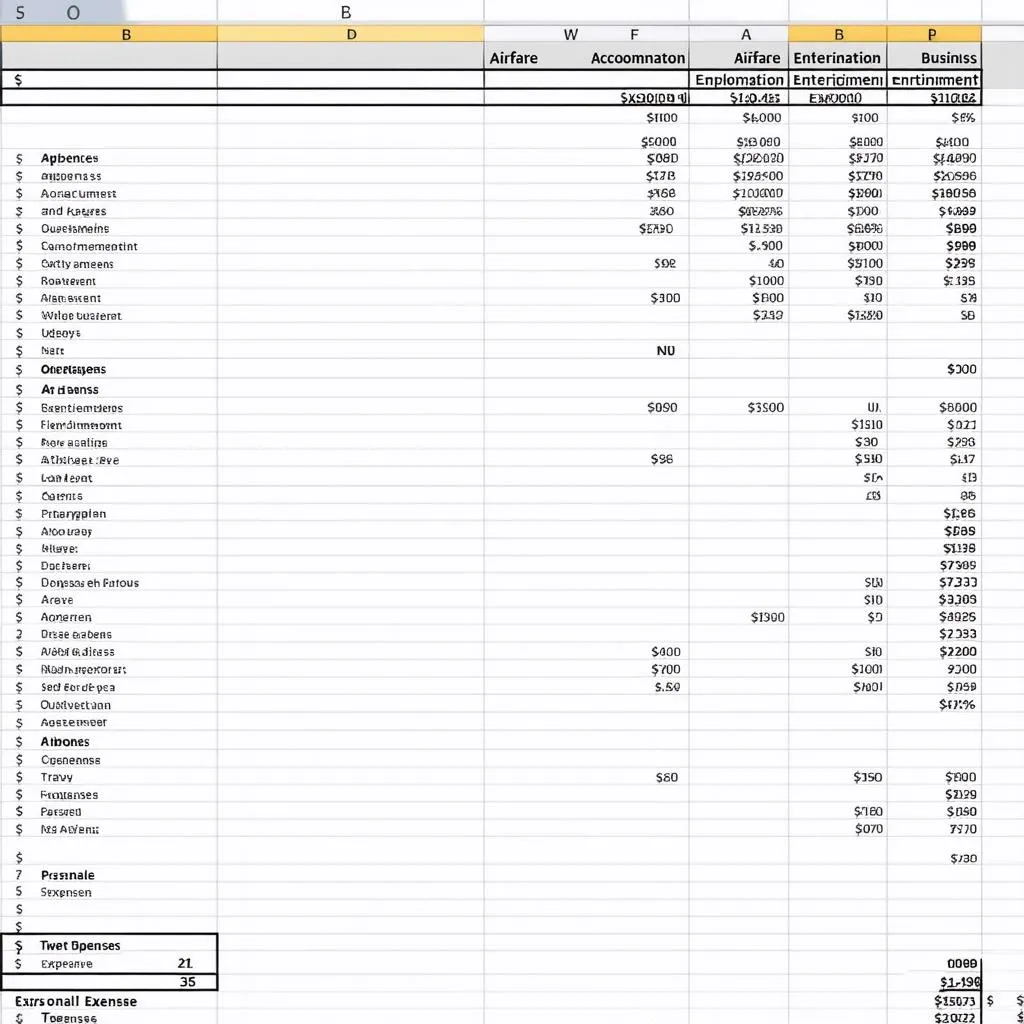

Travel Expenses Spreadsheet

Travel Expenses Spreadsheet

Planning a Business Trip with Feng Shui Principles

Even business travel can benefit from a touch of Feng Shui. Before embarking on your next trip, consider these tips:

- Pack Intentionally: Choose luggage in colors that promote a sense of calm and organization, like navy blue or earthy tones.

- Organize Your Workspace: If you’re working from your hotel room, arrange your belongings in a way that maximizes productivity and minimizes stress.

- Connect with Nature: Take breaks to explore parks or gardens. Spending time in nature can boost creativity and reduce mental fatigue.

Packing a suitcase with Feng Shui principles

Packing a suitcase with Feng Shui principles

FAQs:

Q: Can I deduct my travel expenses if I extend my trip for leisure?

A: You can deduct the portion of your travel expenses directly related to your business activities. However, personal expenses incurred during an extended stay are generally not deductible.

Q: What documentation do I need to support my business travel expenses?

A: It’s crucial to keep detailed records of all expenses, including receipts, invoices, and a travel diary outlining the business purpose of each expenditure.

Travel Smarter with travelcar.edu.vn

Navigating the world of business travel can be complex, but it doesn’t have to be stressful. Remember to plan carefully, keep accurate records, and don’t forget to enjoy the journey! For more travel tips and resources, visit travelcar.edu.vn.

We hope this article has shed some light on the intricacies of business travel expenses. Happy travels!