Planning a trip to the bustling streets of Bangkok or a relaxing escape to the serene beaches of Bali? While the excitement of exploring new cultures and landscapes is exhilarating, unforeseen events like medical emergencies, lost luggage, or trip cancellations can quickly turn your dream vacation into a stressful situation. That’s where AIG International Travel Insurance steps in, offering you peace of mind and financial protection so you can focus on making unforgettable memories.

What is AIG International Travel Insurance?

Imagine this: You’re about to embark on a long-awaited trek through the Himalayas, but a sudden illness prevents you from going. Or, picture yourself exploring the ancient ruins of Rome, only to have your luggage and passport stolen. AIG International Travel Insurance acts as your safety net in such scenarios, providing coverage for a wide range of travel-related mishaps.

AIG, a globally recognized insurance provider with a long-standing reputation, offers various plans tailored to different travel needs and budgets. Whether you’re a seasoned globetrotter or a first-time traveler, AIG has a plan to suit your requirements.

Why Choose AIG International Travel Insurance?

Comprehensive Coverage:

AIG’s travel insurance plans offer a wide spectrum of coverage options, including:

- Medical Emergencies: From unexpected illnesses to accidental injuries, AIG ensures you have access to quality medical care while abroad.

- Trip Cancellation/Interruption: Life is full of surprises, and sometimes those surprises can disrupt your travel plans. AIG provides coverage for non-refundable trip costs in case of cancellations or interruptions due to covered reasons.

- Baggage Loss/Delay: Losing your luggage can put a damper on any trip. AIG’s coverage reimburses you for lost, stolen, or damaged baggage, ensuring you have essential items during your trip.

- Emergency Evacuation: In extreme situations requiring medical evacuation, AIG ensures you receive timely and appropriate transportation.

- 24/7 Travel Assistance: From navigating language barriers to finding lost passports, AIG’s dedicated assistance team is available round-the-clock to assist you with any travel-related emergencies.

Global Network of Providers:

With a vast network of medical providers and travel assistance partners worldwide, AIG ensures you have access to reliable support and services no matter where your adventures take you.

Flexible Plan Options:

AIG offers a range of plans, from basic coverage to comprehensive packages, allowing you to choose the plan that best aligns with your travel needs and budget.

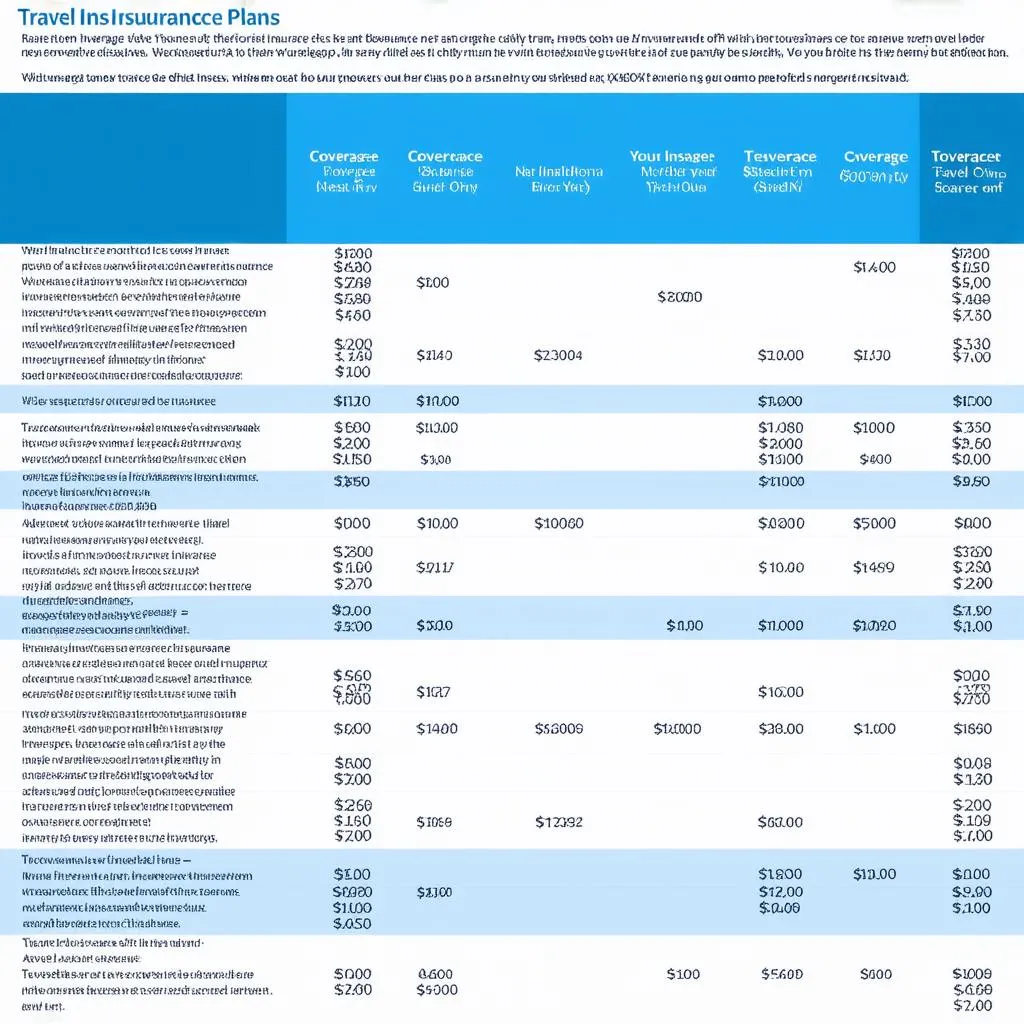

Travel Insurance Comparison

Travel Insurance Comparison

Planning Your Trip? Here’s What to Consider:

1. Destination and Activities:

Your destination and planned activities play a crucial role in determining the right insurance coverage. For instance, adventure activities like skiing or scuba diving may require additional coverage.

2. Trip Duration and Frequency:

AIG offers single-trip and multi-trip plans, allowing you to select coverage based on your travel frequency.

3. Pre-existing Medical Conditions:

Declare any pre-existing medical conditions to ensure you have appropriate coverage.

4. Policy Exclusions:

Carefully review the policy wording to understand what’s covered and what’s not.

FAQs about AIG International Travel Insurance

Q: When should I purchase travel insurance?

A: It’s best to purchase travel insurance as soon as you book your trip to maximize coverage benefits.

Q: Can I extend my AIG travel insurance if my trip gets extended?

A: Yes, you can usually extend your coverage, provided you do so before the original policy expires.

Q: How do I file a claim with AIG?

A: AIG provides a straightforward online claims process, along with phone and email support.

Embracing the Unexpected: A Travel Story

Last year, I planned a trip to Vietnam, eager to explore the bustling streets of Hanoi and the scenic landscapes of Ha Long Bay. I had booked my flights, secured my visa, and meticulously planned my itinerary. However, just a week before my departure, I slipped and fractured my ankle. Devastated, I thought I had to cancel my dream trip. Thankfully, I had purchased AIG travel insurance. They not only reimbursed my non-refundable flight and accommodation costs but also provided support throughout the process.

Travel Insurance Reimbursement

Travel Insurance Reimbursement

This experience underscored the importance of having travel insurance, not just for unforeseen medical emergencies but also for peace of mind. Knowing I had a safety net allowed me to focus on my recovery and reschedule my trip with confidence.

Travel with Confidence: Explore the World with Peace of Mind

Investing in AIG International Travel Insurance is an investment in your peace of mind. By protecting yourself against unforeseen circumstances, you can fully embrace the joy of travel and create unforgettable memories.

Ready to embark on your next adventure? Visit travelcar.edu.vn to learn more about travel tips, destination guides, and the importance of responsible tourism. Safe travels!