Picture this: you’re sipping on cà phê trứng in a charming café on Hanoi’s bustling Hang Gai Street, the aroma of strong coffee and sweet egg yolk filling your senses. As you savor the unique flavors, a thought pops into your head – “How does personal income tax work in Vietnam?”

Don’t worry, you’re not alone. Navigating the tax system in a new country can be as puzzling as finding the best bún chả spot in Hanoi’s labyrinthine Old Quarter. But fret not, dear traveler, this comprehensive guide will equip you with all the knowledge you need to conquer your Vietnamese tax obligations like a seasoned expat.

Understanding the Vietnamese Tax Landscape

Vietnam’s tax system might seem a bit like its traffic at first glance – bustling and seemingly chaotic. But with a little understanding, you’ll find it follows clear rules. As a foreigner working in Vietnam, you’re generally considered a “resident taxpayer” if you meet either of these criteria:

- Residency Test 1: You reside in Vietnam for 183 days or more in a calendar year or 183 days or more in a consecutive 12-month period.

- Residency Test 2: You have a place of residence in Vietnam and intend to stay in Vietnam for 183 days or more in the following calendar year.

If you don’t meet these conditions, you’re considered a “non-resident taxpayer.” Now, why is this important? Well, your residency status determines how your income is taxed in Vietnam.

Decoding Personal Income Tax in Hanoi

Let’s dive deeper into the nitty-gritty of personal income tax, particularly for our friends living and working in Hanoi.

Types of Income: What’s Taxable?

Vietnam taxes worldwide income for resident taxpayers, meaning income earned both within and outside Vietnam is subject to tax. Non-resident taxpayers are only taxed on income sourced from Vietnam. Here’s a glimpse of common income types:

- Employment Income: Salaries, wages, bonuses, and benefits.

- Business Income: Profits from your entrepreneurial ventures.

- Investment Income: Dividends, interest, and rental income.

- Capital Gains: Profits from selling assets like property.

Tax Rates: What’s the Damage?

Vietnam has a progressive tax system, which means higher earners pay a larger percentage of their income in tax. The tax rates for resident taxpayers range from 5% to 35%, depending on your income level. For non-resident taxpayers, a flat tax rate of 20% is applied to most types of income.

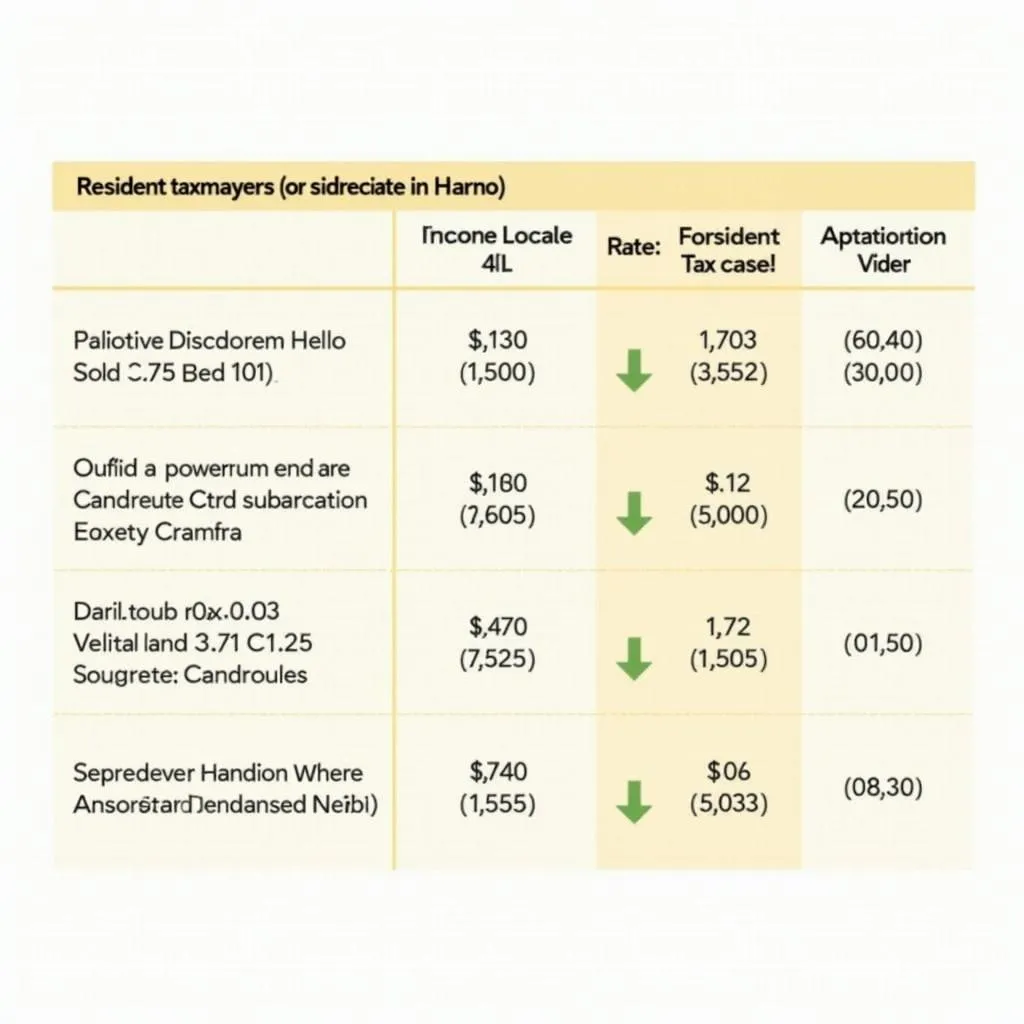

Hanoi Tax Brackets for Residents

Hanoi Tax Brackets for Residents

Tax Deductions: Lightening the Load

Just like in many countries, Vietnam offers several deductions and allowances to reduce your taxable income. Some common ones include:

- Personal Deduction: A fixed amount deducted from your taxable income.

- Dependent Deductions: For your spouse, children, or other qualifying dependents.

- Insurance Premiums: Deductions for certain health and social insurance contributions.

Hanoi Tax Deductions for Expats

Hanoi Tax Deductions for Expats

Filing Your Tax Return: The Final Act

The Vietnamese tax year follows the calendar year, and the deadline to file your tax return is March 31st of the following year. You can file your tax return online, by mail, or in person at the tax department in your district.

Tip from a Hanoi Local: Did you know? In Vietnamese culture, the number 8 is considered lucky because it sounds similar to the word for “prosperity.” Consider filing your tax return on a date with the number 8 for good fortune!

Navigating Tax Challenges: Don’t Get Lost in Translation!

Let’s be real, dealing with taxes in a foreign language can be a bit daunting. If you’re feeling overwhelmed, remember:

- Seek Professional Help: Consider consulting with a qualified tax advisor or accountant in Hanoi. They can guide you through the intricacies of Vietnamese tax laws and ensure you meet all your obligations.

- Utilize Online Resources: The General Department of Taxation (GDT) offers helpful information in English on their website.

- Don’t Be Afraid to Ask Questions: Reach out to your employer, colleagues, or fellow expats for clarification on any tax-related matters.

Pro Tip: Many cafes around Hoan Kiem Lake offer free Wi-Fi. Take advantage of these spots to research and familiarize yourself with Vietnamese tax regulations.

Beyond Taxes: Exploring Hanoi’s Hidden Gems

Now that you’re well-equipped to tackle your tax obligations, let’s shift gears to the more exciting aspects of Hanoi life! While you’re here, be sure to:

- Explore the Tran Quoc Pagoda: Immerse yourself in the tranquility of this ancient Buddhist temple on the shores of West Lake.

- Indulge in a Food Tour: Embark on a culinary adventure through Hanoi’s vibrant streets, sampling local delicacies like phở, bún chả, and egg coffee.

- Catch a Water Puppet Show: Witness this unique Vietnamese art form at Thang Long Water Puppet Theatre.

Getting Around Hanoi: Need a reliable ride to navigate Hanoi’s bustling streets? TRAVELCAR offers comfortable and affordable car rental services, airport transfers, and customized tours. Choose from our fleet of 16-seater, 29-seater, and 45-seater vehicles to explore Hanoi and its surrounding areas at your own pace.

Ready to Conquer Hanoi?

We hope this guide has shed some light on the world of personal income tax in Vietnam. Remember, understanding your tax obligations is an essential part of living and working in Hanoi. But don’t let taxes overshadow your experience – embrace the city’s vibrant culture, delicious cuisine, and captivating history.

Need help navigating Hanoi? Contact TRAVELCAR!

Call: 0372960696

Email: [email protected]

Visit Us: 260 Cầu Giấy, Hà Nội

TRAVELCAR: Your Trusted Travel Companion in Hanoi!