Have you ever heard the old Vietnamese saying, “Biển lặng không tạo nên thủy thủ giỏi”? In the world of trading, calm seas don’t often lead to impressive profits. To navigate the often choppy waters of the stock market, many traders turn to the Elliott Wave Theory – a method as captivating and potentially profitable as the ocean itself.

Riding the Waves of Market Psychology

At its core, Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, posits that market prices move in predictable, repetitive cycles or “waves” driven by investor psychology. Imagine a bustling market in Hanoi’s Old Quarter – the ebb and flow of the crowd, the bursts of excitement followed by moments of calm. Elliott Wave Theory suggests that these patterns, reflecting collective optimism and pessimism, are mirrored in the financial markets.

Deciphering the Five-Wave Pattern

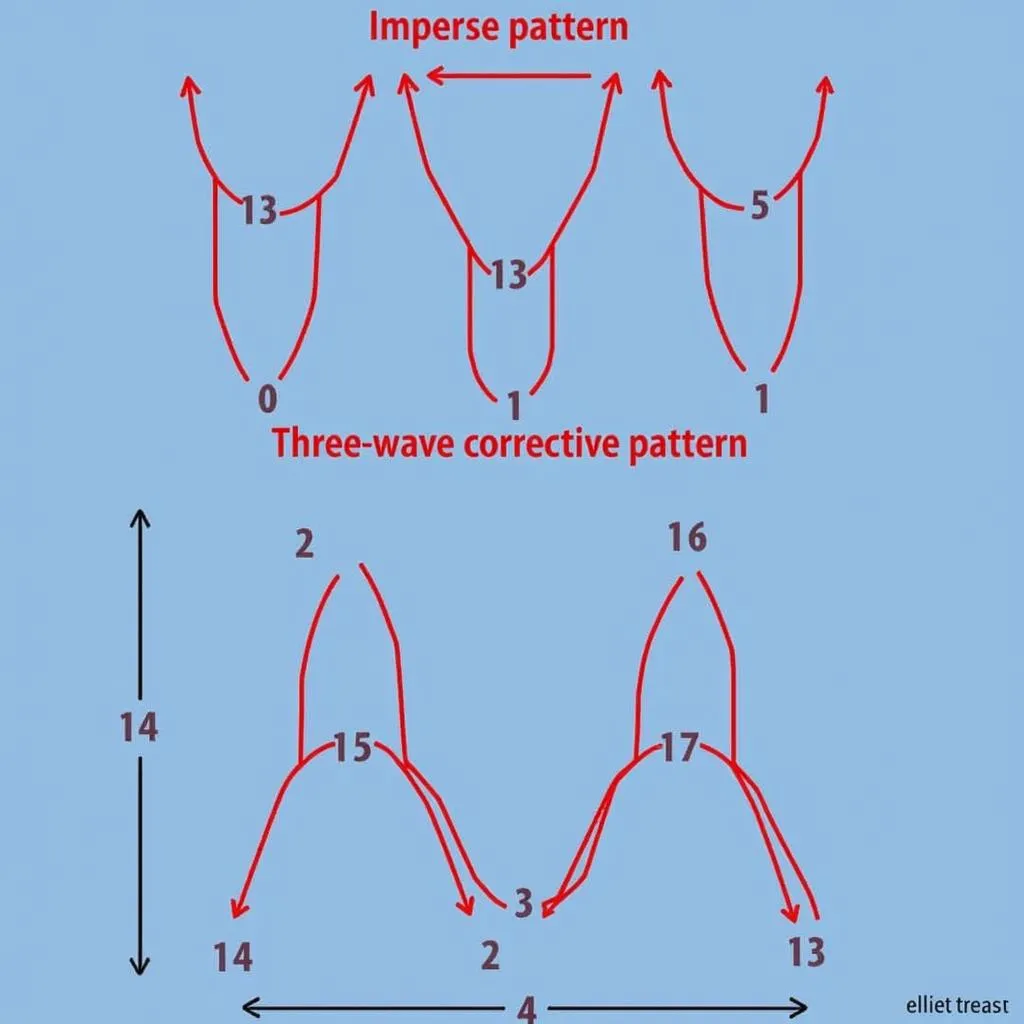

The Elliott Wave Theory identifies two primary wave types:

- Impulse Waves: These are the powerful waves that move in the direction of the larger trend, comprised of five sub-waves.

- Corrective Waves: These waves, composed of three sub-waves, move against the main trend, acting as a temporary pullback before the dominant force resumes.

Elliott Wave Impulse and Corrective Patterns

Elliott Wave Impulse and Corrective Patterns

Unveiling the Fibonacci Connection

Intriguingly, Elliott Wave practitioners often use Fibonacci ratios (like 0.618, 1.618) to predict the length and timing of these waves. Just as the Golden Ratio appears in nature, from seashells to sunflowers, these mathematical relationships seem to resonate within market movements. This blend of natural patterns and financial analysis makes Elliott Wave Theory a unique tool for traders seeking an edge.

Navigating the Challenges of Elliott Wave Trading

While the theory offers enticing possibilities, mastering the art of wave counting and interpretation requires patience, practice, and a keen eye for detail. Like navigating the bustling streets of Hoan Kiem District during rush hour, it can be challenging to discern the underlying order amidst the seeming chaos.

Common Pitfalls and How to Avoid Them

- Subjectivity: One of the main critiques of Elliott Wave Theory is its subjective nature. Different analysts might identify wave patterns differently, leading to varying interpretations.

- Complexity: Grasping the nuances of wave relationships and Fibonacci applications can be daunting for beginners.

Tips for Successful Elliott Wave Trading

- Start with the Basics: Focus on understanding the core principles of impulse and corrective waves before delving into complex patterns.

- Practice Makes Progress: Utilize charting software and historical data to practice identifying wave counts and potential trading setups.

- Combine with Other Indicators: Consider incorporating other technical analysis tools to confirm Elliott Wave signals and manage risk.

Elliott Wave Trading Chart Example

Elliott Wave Trading Chart Example

Riding the Waves with Confidence: Is Elliott Wave Theory Right for You?

Just as a seasoned xe ôm driver navigates Hanoi’s labyrinthine streets, experienced Elliott Wave traders can potentially use this theory to identify high-probability trading opportunities. However, it’s crucial to remember that no trading strategy guarantees profits.

Whether you’re a seasoned investor in Ba Dinh District or a newcomer to the world of trading in Tay Ho, understanding the principles of Elliott Wave Theory can provide valuable insights into the rhythmic dance of market psychology. Remember, like any journey, thorough preparation, continuous learning, and a touch of adventurous spirit can lead to the most rewarding experiences.

Need help navigating the markets?

Contact TRAVELCAR today! We’re more than just transportation – we’re your partners in exploration. Whether you need a comfortable ride from Noi Bai International Airport or a customized tour of Hanoi’s hidden gems, our team is here to help. Call us at 0372960696, email us at [email protected], or visit our office at 260 Cầu Giấy, Hà Nội. Let us guide you on your journey!