Ever booked a flight, excitement bubbling in your chest, only for disaster to strike? A sudden illness, a missed connection, or even lost luggage can quickly turn your dream vacation into a logistical (and financial) nightmare. That’s where travel insurance swoops in, promising a safety net for the unexpected. But is travel insurance for flights really worth it? Let’s unpack this question and see if it’s a worthwhile investment for your next big adventure.

Understanding Travel Insurance for Flights

Think of travel insurance as a financial buffer against the “what ifs” of travel. Specifically, flight insurance typically covers issues like:

- Trip Cancellation/Interruption: Imagine a sudden illness prevents you from boarding that flight to Bali. Trip cancellation/interruption coverage can reimburse you for non-refundable costs like flights and accommodations.

- Flight Delays/Missed Connections: We’ve all been there – stuck at JFK with a missed connection, facing hefty rebooking fees. This coverage can help alleviate those costs.

- Lost/Delayed Baggage: Picture landing in Rome, ready for pasta and sightseeing, only to discover your luggage decided to take a detour to Buenos Aires. This insurance can help cover the cost of essential items while you wait for your belongings.

- Medical Emergencies: From a nasty bout of food poisoning in Bangkok to a sprained ankle hiking the Inca Trail, medical emergencies abroad can be expensive. Travel insurance can provide coverage for medical expenses, emergency evacuation, and more.

Travel insurance coverage

Travel insurance coverage

So, Is It Worth It? Factors to Consider

The million-dollar question (or rather, the potentially hundreds-of-dollars-saved question) is whether flight insurance is right for you. Here’s a breakdown to help you decide:

1. The Cost of Your Trip

Are you jetting off on a weekend getaway to Miami or embarking on a month-long backpacking adventure through Southeast Asia? The cost of your trip plays a significant role in determining the value of insurance. Generally, the more expensive your trip, the more valuable the insurance becomes.

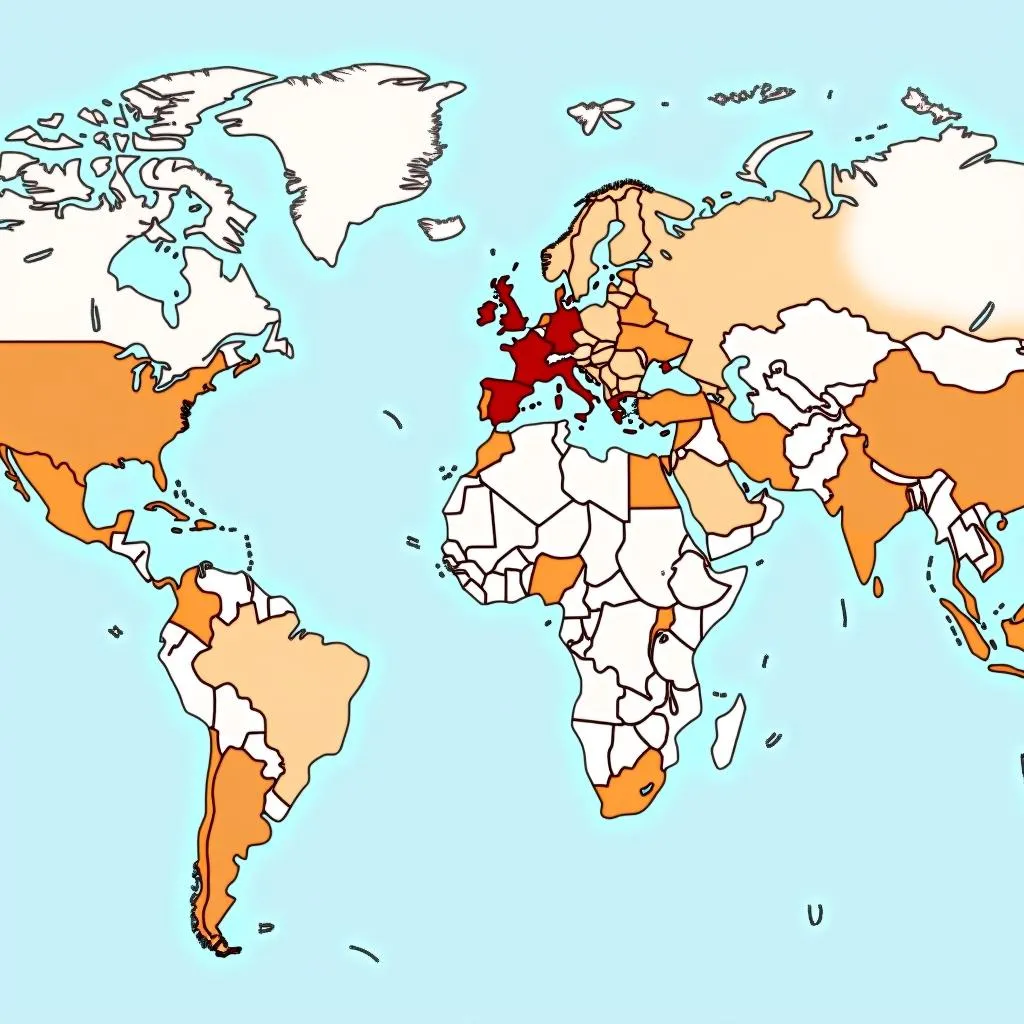

2. Your Destination

Some destinations, like bustling Marrakech or remote regions of Nepal, may pose higher risks in terms of medical care or travel disruptions. Consider the potential challenges and accessibility of resources at your destination when evaluating insurance.

World map highlighting travel destinations and their associated risks.

World map highlighting travel destinations and their associated risks.

3. Your Personal Health and Risk Tolerance

If you have pre-existing medical conditions or tend to be more risk-averse, travel insurance offers peace of mind and financial protection in case the unexpected arises.

4. Existing Coverage

Check if you have coverage through your credit card or homeowner’s/renter’s insurance. Some policies offer limited travel protection, but it’s crucial to understand the extent of their coverage.

Debunking Travel Insurance Myths

Myth: Travel insurance is a waste of money – I’m young and healthy!

Reality: Age is just one factor. Unexpected events can happen to anyone, and medical expenses abroad can quickly drain your savings.

Myth: I can just rely on my credit card’s travel protection.

Reality: While some credit cards offer travel benefits, coverage can be limited and may not cover all scenarios. Always read the fine print!

Planning Your Trip? Here’s a Checklist!

- Research Your Destination: Understand the potential risks and challenges associated with your chosen locale.

- Compare Insurance Options: Don’t just grab the first policy you see! Compare coverage, deductibles, and premiums from reputable providers.

- Read the Fine Print: We can’t stress this enough! Understand what’s covered, what’s excluded, and the claims process.

Travel insurance comparison checklist

Travel insurance comparison checklist

Frequently Asked Questions

Q: Can I purchase travel insurance after booking my flight?

A: Yes, but it’s generally recommended to purchase it soon after booking your trip to maximize coverage options.

Q: What if my flight is delayed due to weather?

A: Coverage for weather-related delays varies depending on your policy. Look for policies that specifically mention weather-related coverage.

Travel With Peace of Mind

Just like you wouldn’t embark on a road trip without car insurance, consider travel insurance as an essential part of your trip planning process. It’s an investment in your peace of mind, allowing you to fully embrace the joys of travel, knowing you’re protected against the unexpected.

For more travel tips and resources, explore the wealth of information available at TRAVELCAR.edu.vn. Happy travels!