Have you ever dreamt of standing in the shadow of the Eiffel Tower, feeling the mist from Niagara Falls on your face, or wandering through the ancient ruins of Rome? Travel, with its promise of adventure and discovery, calls to us all. But planning a trip, especially an international one, can feel daunting. One way to simplify the process and unlock a world of benefits is with a travel card.

What is a Travel Card?

A travel card is a prepaid card that you load with a specific currency before you travel. It acts like a debit card, allowing you to make purchases and withdraw cash at ATMs worldwide without the hassle of exchanging currency at every stop.

Why Choose a Travel Card?

Convenience and Security

Imagine landing in a bustling foreign airport, only to find the currency exchange closed. With a travel card, you’re always prepared. They offer a safe and convenient alternative to carrying large amounts of cash, and in case of loss or theft, many providers offer protection and assistance.

Control Your Budget

Travel cards help you stick to your budget. By loading a predetermined amount, you can avoid overspending and track your expenses easily.

Favorable Exchange Rates

“When I travelled through Southeast Asia,” shares travel blogger, Anya Patel in her book “Backpacking on a Budget”, “using a travel card saved me a significant amount on exchange rates compared to traditional money changers.”

Global Acceptance

Most travel cards are affiliated with major payment networks like Visa or Mastercard, ensuring wide acceptance at millions of locations globally.

Choosing the Right Travel Card

With a plethora of travel cards available, selecting the right one can seem overwhelming. Consider these factors:

Fees

Pay close attention to fees such as:

- Loading fees: Charged when you load money onto the card.

- Transaction fees: Charged for purchases or ATM withdrawals.

- Inactivity fees: Charged if the card isn’t used for a certain period.

Currency Conversion Rates

Compare the exchange rates offered by different providers to ensure you’re getting the best value for your money.

Additional Features

Some cards offer perks like:

- Travel insurance: Provides coverage for medical emergencies, lost luggage, and other travel mishaps.

- Rewards programs: Earn points or miles on your spending that can be redeemed for flights, hotels, and other travel expenses.

Planning Your Trip with a Travel Card

Once you’ve chosen your travel card, here’s how to maximize its benefits:

- Research and Compare: Use online comparison websites to find a card that aligns with your travel needs and budget.

- Load Your Card: Load your card with sufficient funds before your trip, considering potential expenses and emergencies.

- Notify Your Provider: Inform your card provider about your travel dates and destinations to avoid any potential issues with transactions being flagged as suspicious.

Travel Card FAQs

Q: Can I use a travel card anywhere in the world?

A: Most travel cards are widely accepted globally, but it’s always wise to check with the provider for specific country restrictions.

Q: What happens if my travel card is lost or stolen?

A: Immediately contact your card provider to report the loss or theft. They can typically block the card and assist you with getting a replacement.

Q: Can I use my travel card after my trip?

A: Yes, many travel cards allow you to keep the remaining balance and use it for future trips or everyday purchases.

Travel with Peace of Mind

A travel card can be your passport to stress-free spending abroad. By understanding the features, fees, and benefits, you can choose the right card to unlock a world of travel experiences without the financial worries.

Ready to explore? Discover amazing travel destinations and plan your next adventure with TRAVELCAR.edu.vn!

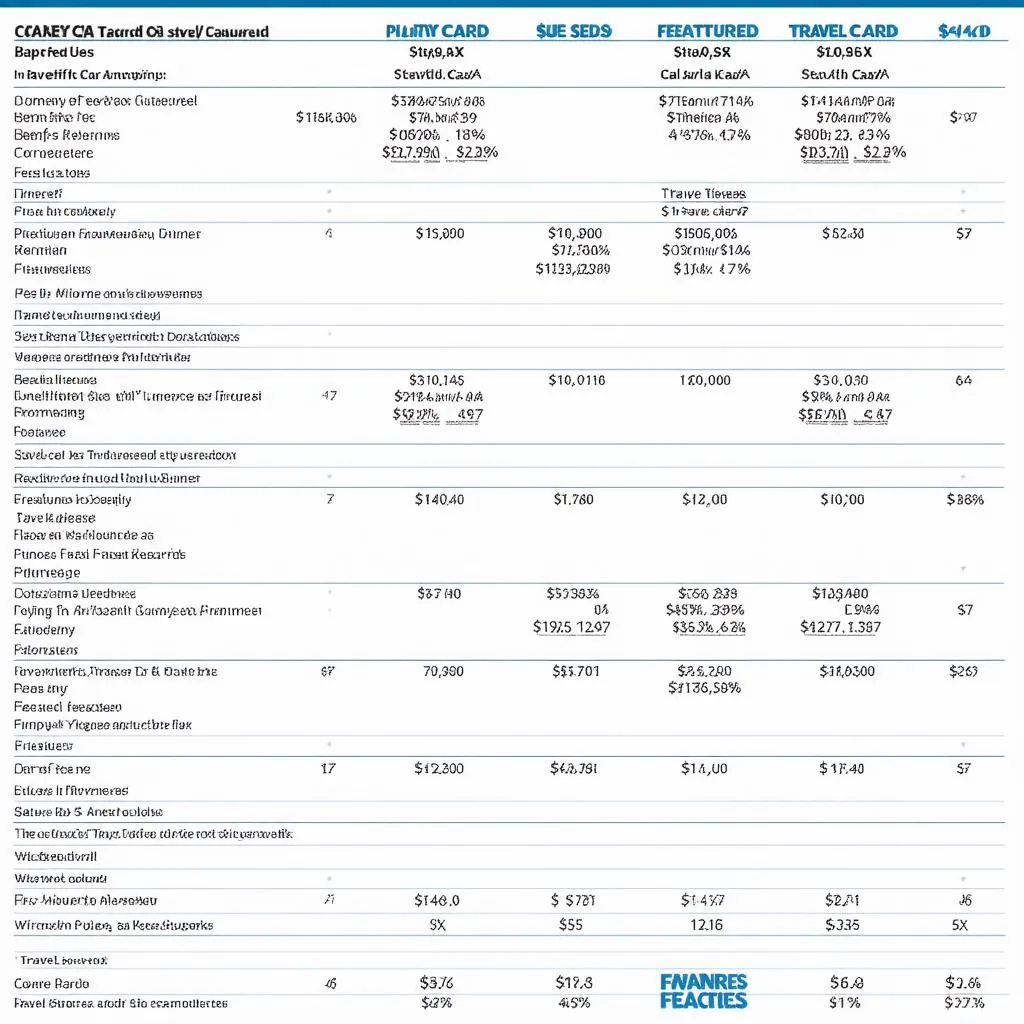

Travel Card Comparison Chart

Travel Card Comparison Chart

Using a Travel Card at a Local Market

Using a Travel Card at a Local Market