Picture this: you’re strolling along the canals of Venice, indulging in the aroma of freshly baked croissants in a Parisian cafe, or perhaps trekking through the ancient ruins of Machu Picchu. Your dream vacation is finally here! But then, the unexpected happens – a missed flight, a lost wallet, or even a sudden illness. This is where the best travel insurance swoops in like a superhero, saving the day and ensuring your trip doesn’t turn into a travel horror story.

What is Travel Insurance and Why Do I Need It?

Travel insurance is a safety net for the unexpected hiccups that life can throw your way, especially when you’re exploring the world. It provides financial protection against various travel risks, including:

- Trip Cancellations & Interruptions: Imagine a sudden illness or a family emergency back home forcing you to cancel your long-awaited trip to the bustling markets of Marrakech. Travel insurance can reimburse you for the non-refundable costs of your flights, accommodations, and tours.

- Medical Emergencies: Falling ill or getting injured in a foreign country like navigating the crowded streets of Bangkok can be stressful and expensive. Travel insurance covers medical expenses, hospital stays, and even emergency medical evacuation if needed.

- Lost or Stolen Belongings: Losing your passport amidst the vibrant chaos of Rio de Janeiro’s Carnival can throw a wrench in your travel plans. Travel insurance can help you replace essential documents, luggage, and other valuables.

What Makes the Best Travel Insurance?

Not all travel insurance policies are created equal. The “best” policy depends on your individual needs and travel style. Consider these factors:

1. Coverage That Suits Your Itinerary:

- Destination: Some countries, like exploring the breathtaking landscapes of Iceland, might require specific coverage like adventure sports protection.

- Activities: Are you planning on skiing in the Swiss Alps or scuba diving in the Great Barrier Reef? Ensure your policy covers these activities.

- Duration: A weekend getaway to the romantic city of Prague will need different coverage compared to a month-long backpacking adventure across Southeast Asia.

2. Benefits That Matter Most:

- Medical Expenses: Look for high coverage limits, especially if you have pre-existing medical conditions or are traveling to countries with expensive healthcare systems.

- Emergency Evacuation: This is crucial for adventure travelers or those venturing off the beaten path in places like the Amazon rainforest.

- Trip Cancellation/Interruption: Understand the reasons for coverage. Some policies might cover cancellations due to work commitments, while others might not.

3. Reputation and Customer Service:

- Reviews: Research online reviews and ratings to gauge the insurance provider’s reliability and customer satisfaction.

- Claims Process: Opt for a company known for a smooth and efficient claims process. You don’t want to be stuck dealing with bureaucratic nightmares while recovering from an illness in a foreign land.

Planning Your Dream Trip? Don’t Forget Travel Insurance!

Just as packing your bags and booking your flights are essential parts of your travel checklist, securing the best travel insurance should be a non-negotiable. Remember that incredible adventure in the Galapagos Islands you’ve always dreamed of? Don’t let unexpected events rain on your parade.

Pro Tip: “The best travel insurance is like a good travel companion – always there when you need it most, providing peace of mind and allowing you to truly enjoy your journey,” says travel expert Sarah Jenkins, author of “The Ultimate Guide to Stress-Free Travel.”

Finding Your Perfect Travel Insurance Policy

With countless options available, finding the right policy can feel overwhelming. But fear not! Websites like travelcar.edu.vn provide comprehensive resources and comparisons to help you make an informed decision. You can explore various insurance providers, compare coverage options, and even get personalized quotes.

Don’t leave your travel plans to chance. Invest in peace of mind and embark on your next adventure knowing you’re fully protected.

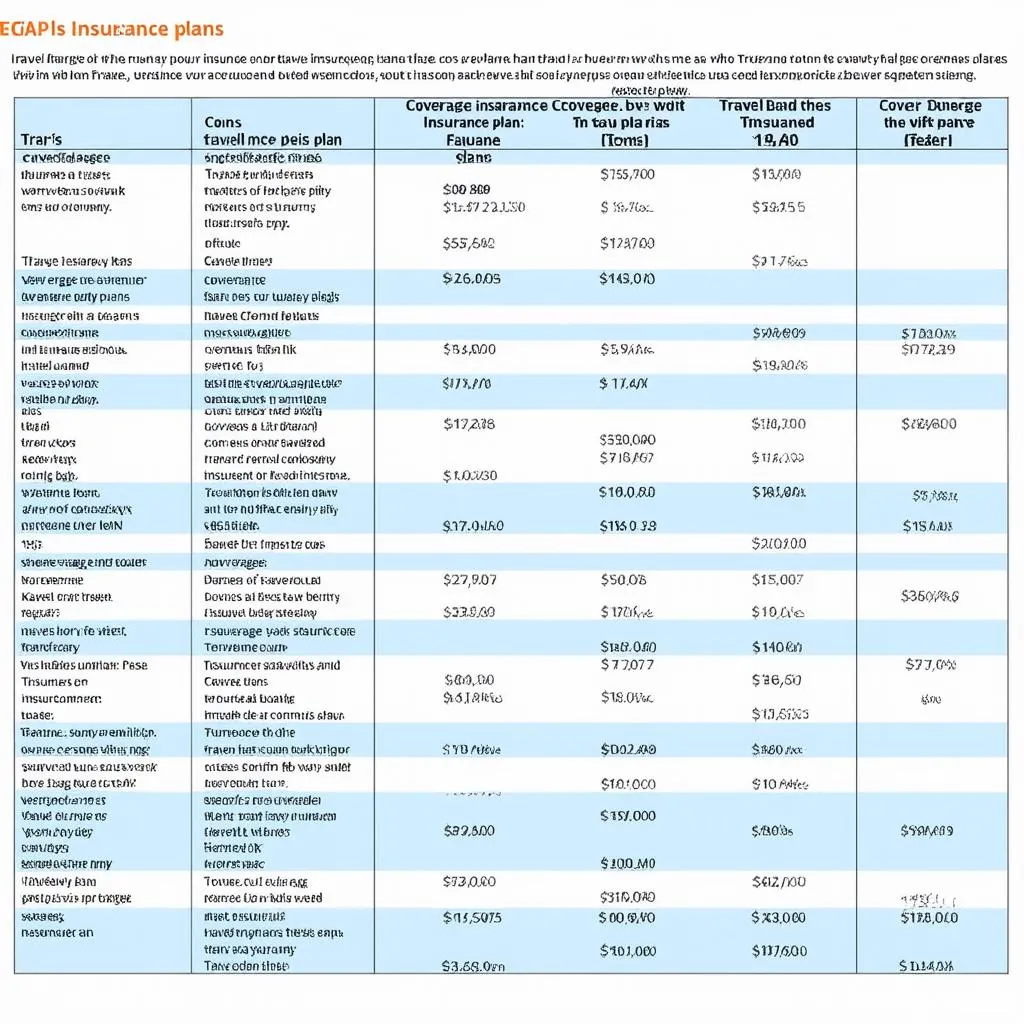

Travel Insurance Comparison

Travel Insurance Comparison

Common Questions about Travel Insurance:

Q: Can I buy travel insurance after booking my trip?

A: Yes, you can typically purchase travel insurance after booking your trip, but it’s recommended to do it as soon as possible. Some policies offer better coverage if purchased within a specific timeframe of your initial trip deposit.

Q: Does travel insurance cover pre-existing medical conditions?

A: It depends on the policy and the provider. Some policies might cover pre-existing conditions if you meet specific criteria, such as having your condition stable for a certain period before your trip.

Q: What if I need to file a claim?

A: Contact your insurance provider immediately. They will guide you through the claims process and provide the necessary forms and documentation requirements. Keep all your travel documents, receipts, and medical records organized for a smoother experience.

Traveler with Insurance

Traveler with Insurance

Explore the World with Confidence with Travelcar.edu.vn

Planning a trip to the vibrant streets of Tokyo or the historical wonders of Rome? Visit TRAVELCAR.edu.vn for valuable travel tips, destination guides, and resources to help you plan your dream vacation.

Start planning your next adventure today!